Soaring Vegetable and Fruit Prices in the US in 2025 Spark Concerns

Soaring Vegetable and Fruit Prices in the US in 2025 Spark Concerns

1 minute read

FTSE 100 Edges Up 0.2% on July 9 as Markets Digest U.S. Tariff Expansion

London’s FTSE 100 inched up 0.2% on July 9, with investors continuing to absorb the impact of U.S. tariff expansions. Advertising giant WPP (WPP.L) plunged 19%—its worst daily drop in over three decades—after slashing profit forecasts due to key client losses and shrinking new business, weighing heavily on the index.

1 minute read

Australian Business Conditions Surge to 1-Year High, Offset by U.S. Tariff Risks

Australia’s business environment improved sharply in June, with NAB’s Business Conditions Index jumping 9 points to a 13-month peak on July 9, while confidence rose for the third straight month (+3 points). All key metrics strengthened: sales surged 10 points, profitability gained 9 points, and employment edged up 2 points. Capacity utilization hit 83.3%, with future orders climbing 2 points, signaling a shift from early-year weakness and stronger second-half momentum, noted NAB’s Australian Economics Head Gareth Spence.

1 minute read

Canada's S&P/TSX Dips 0.2% as Mining Slides; Energy Gains Offer Partial Offset

Canada’s S&P/TSX Composite Index fell 0.2% to 26,959.65 on Tuesday, dragged by a 2.4% plunge in mining. Gold producers led declines: SSR Mining (SSRM.TO) dropped 6.1% and Orla Mining (OLA.TO) 6.5%, reflecting global gold price pullbacks.

1 minute read

Google's Struggles and Growth Avenues in the Digital Landscape

Google, the tech giant, still relies heavily on its search advertising business, which contributes around 80% of its revenue. However, the burgeoning rise of TikTok has started to siphon off its advertising market share. TikTok's unique advertising models and vast user base have attracted numerous advertisers, posing a significant challenge to Google's dominance in the digital advertising space.

1 minute read

Amazon's Dual-Powered Growth: Navigating Challenges and Eyeing New Horizons

Amazon continues to thrive on the twin engines of its e-commerce empire and Amazon Web Services (AWS), with AWS's revenue share climbing to 30% in 2023 while contributing over 60% of the company's profits. This cloud - computing dominance bolsters Amazon's financial strength, even as it confronts intensifying competition from budget - friendly e-commerce rivals like Temu and Shein.

1 minute read

Euro Zone Shows Recovery Signs as Sentix Hits 3-Year High, German Industry Rebounds

The euro zone’s economic outlook brightened in July: the Sentix Investor Confidence Index surged to 4.5 (up from 0.2), a three-year peak and third straight rise. The current conditions sub-index improved to -7.3 (still contracting), while the expectations gauge jumped to 17.0, signaling optimism. Germany’s index rose to -0.4 (highest since February 2022), with its current conditions improving for five months. Analysts warn sustained recovery could limit the ECB’s rate-cut room.

1 minute read

UK House Prices Stabilize; Corporate Investment Shifts Toward Britain

UK house prices showed signs of stabilization in June, with Halifax data recording zero month-on-month growth (previous figure revised up to -0.3%) and annual gains edging down to 2.5%. While April’s stamp duty hike dampened activity—prices are slightly lower than late 2023—mortgage rates have fallen to their lowest since 2023. Halifax Mortgages Director Amanda Bladen noted wage growth is supporting market resilience, with two rate cuts expected this year likely to drive modest price recoveries in H2.

1 minute read

Berkshire Hathaway Under Buffett: Capital Strength and Uncertain Future Horizons

Under the stewardship of Warren Buffett, Berkshire Hathaway has long leveraged insurance float as its core capital, amassing a portfolio of prime assets including Apple and Coca - Cola. In 2023, the company’s cash reserves soared to a record - high $147 billion, a clear signal of its cautious stance amidst perceived market bubbles. This financial positioning reflects Buffett’s time - tested investment acumen, but also stirs questions about the firm’s future direction.

1 minute read

Australian Shares Edge Higher on Wall Street Record; RBA Rate Cut in Focus

Australian stocks rose modestly on Friday (July 5), buoyed by fresh record highs on Wall Street. The S&P/ASX 200 gained 0.17% to 8,610 in midday trade—less than 30 points from its all-time peak—while the All Ordinaries Index added 0.16% to 8,847.3. Despite stronger-than-expected U.S. jobs data dampening hopes for a July Fed rate cut, markets reacted positively to signs of economic resilience.

1 minute read

SkySpecs raised $20 million for its renewable energy asset health management

SkySpecs raised $20 million for its renewable energy asset health management

1 minute read

China - Australia Trade Recovery Drives Growth in Australian Wine and Lamb Exports

In the year to March 2025, the recovery of China - Australia trade has brought good news to the Australian wine and lamb industries. The export value of Australian wine to China has soared by 1.01 billion Australian dollars to 1.03 billion Australian dollars. The return of leading wine companies such as Treasury Wine Estates has been the key driving force, leading to a 41% increase in the total export value of Australian wine to 2.64 billion Australian dollars.

1 minute read

Australian Stocks Surge 0.92% to Top 8000, with Uranium Shares Leading the Way

On April 29, the S&P/ASX 200 index in Australia witnessed a significant upswing. It climbed 73.5 points, or 0.92%, to close at 8070.6 points, hitting a new eight - week high. The market sentiment received a boost from the 利好 news of the United States reducing tariffs on auto parts.

1 minute read

Japan's Economy Shrinks in Q1 as US Tariffs Hit Auto Industry

Japan's economy is expected to have shrunk by 0.2% on an annualized basis in the first quarter, the first negative growth in a year, according to a Reuters poll. The main reasons are weak domestic demand and imports growing faster than exports. Private consumption increased only slightly by 0.1%, as rising food prices curbed spending. Capital expenditure rose by 0.8%, but net exports dragged down GDP by 0.6%.

1 minute read

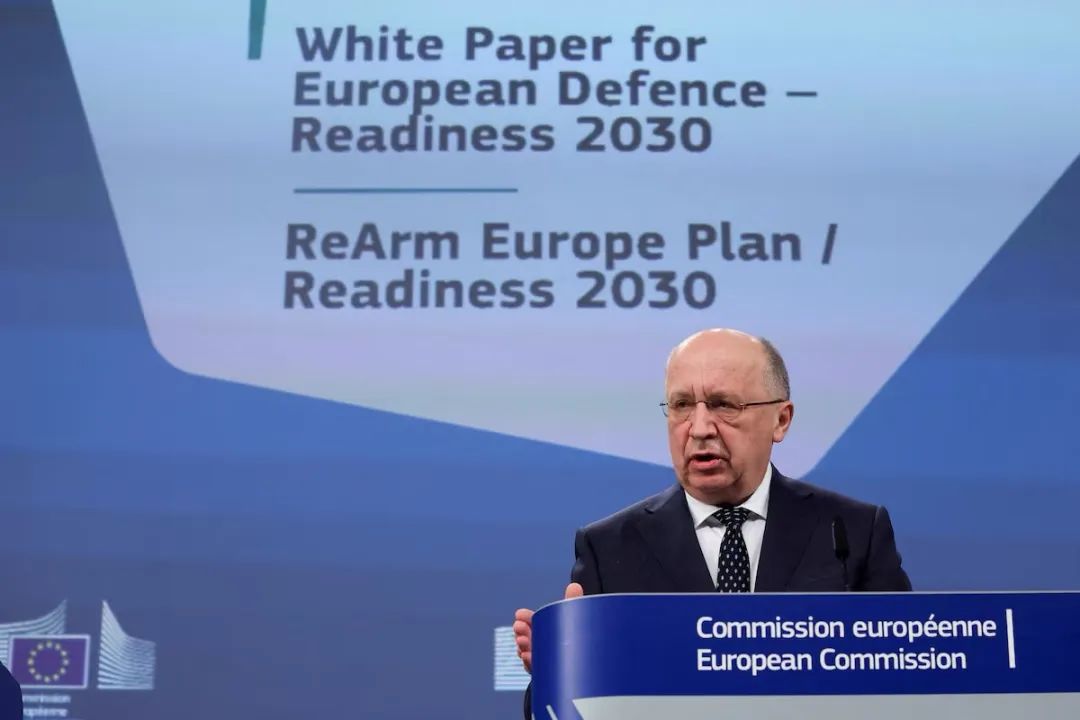

France and Spain Face Hurdles in Economic Policy Adjustment: Fiscal Austerity and Military Spending Pressure

In France, on May 3rd, Prime Minister Bérut stated that in order to defuse the social backlash caused by large - scale fiscal austerity, he is considering holding a referendum on the national budget, claiming that debt reduction is crucial for the "future of the country" and requires a decision from the entire population.

1 minute read